Maintaining Capital in Tourism Sector Urgently Needed

Yoshida Yushi, Professor of Economics, Shiga University

Prof. Yoshida Yushi

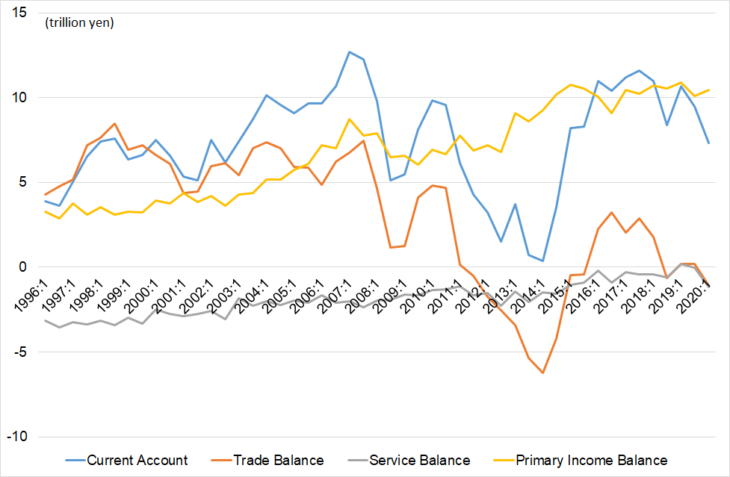

In the 21st century, Japan’s current account (CA) has undergone a sea change. This is partly due to external shocks, namely the Global Financial Crisis of 2008, which depressed global demand, and the Great East Japan Earthquake of 2011, which caused substantial damage to the domestic production base. The COVID-19 Shock of 2020, however, has had a completely different impact.

Broadly speaking, CA can be divided into the balance of trade, services, and income. The balance of trade is the difference between the value of exports and the value of imports; the balance on services is the difference between country’s inbound travel and transportation and country’s outbound travel and transportation; and the balance on income is the difference between income (compensation of employees and investment income) earned from overseas and income paid overseas.

For many years, the behavior of Japan’s CA closely mirrored that of the trade balance. The huge trade balance surplus, driven by exports by Japan’s leading companies, contributed to the CA surplus. However, after the trade balance recorded its first loss in 31 years in 2011, it never returned to a significant surplus. On the other hand, the rising demand on inbound services brought the balance on services, which had always shown a deficit, into the surplus in 2019. The amount of service balance is, however, very small compared to the other two components of CA. Meanwhile, the world’s largest net overseas assets (around US$3.4 trillion, as of the end of 2019), built up over years of CA surpluses, have received dividends and interest payments from around the world, further expanding the income balance surplus. As shown in Figure 1, as of 2019, the CA=trade balance structure had completely collapsed. Then the COVID-19 Shock hit Japan as well as the rest of the world.

During the Global Financial Crisis, severe damage in the European and US financial sectors in turn rippled through all sectors of the world economy. One of the greatest impacts was on international trade. The decline in world trade at the time of the so-called Great Trade Collapse far outstripped the decline in the world economy. As many regions of the world experienced economic decline, a drop in demand for products made overseas was to be expected. However, the drop in international trade was even greater than anticipated, drawing the attention of researchers around the world. Likewise, the current COVID-19 crisis has depressed the economies of many nations, with lower demand and consumption resulting in a significant decline in international trade. According to the IMF’s 2020 External Sector Report (July 24), in the first five months of 2020 world trade decreased by 20 percent compared to the previous year, a far greater decrease than in the first five months of the Global Financial Crisis.

Figure 1: Breakdown of Japan’s BOP (first half of 1996 to first half of 2020)

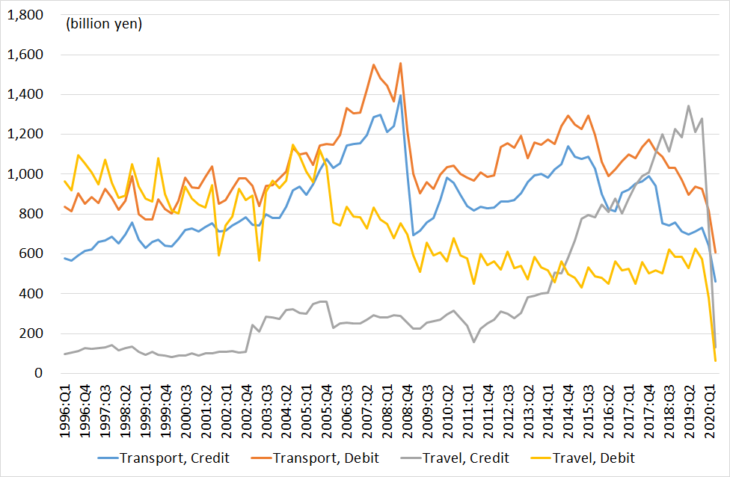

For the economies of Japan and much of the rest of the world, the balance on services, of which overseas travel comprises a large part, has been more greatly impacted. I have coined the term “Great Service-Trade Collapse” to describe this situation. In particular, Japan’s tourism-related services (travel and passenger transportation) as the share of total service payments and service receipts has plummeted to 3.5% and 1.3%, respectively, in the second quarter of 2020. Compared to the share of 25.0% and 12.6% respectively seen in the second quarter a year ago, this is an enormous drop. Not all payments for services and receipts from services have been lost, however: The balance on services includes intellectual property rights and usage fees, and financial and technical service fees, which have been less impacted by the COVID-19 Shock. On the other hand, Thailand and Greece, where tourism is a major industry, have experienced a decline in service balance of approximately 6% of GDP.

How did Japan’s CA compare to that of the rest of the world in 2019, before the COVID-19 crisis? The IMF’s External Sector Report measures the CA gap for 29 major countries of the world economy. The report uses a multilateral model to measure the gap between the CA that matches the current economic fundamentals of each country (which need not necessarily be zero) and the actual CA. According to the CA gap criteria, Belgium, Saudi Arabia, the United Kingdom, and Argentina are classified as having a “weaker” CA, while Singapore, Germany, the Netherlands, and Thailand are classified as having a “substantially stronger” CA. Japan is rated as having a “broadly in line with fundamentals and desirable policy settings” CA. This differs significantly from the 1980s, when Japan’s trade balance with the United States was in a large surplus and developed to the point of Japan-US trade conflicts.

Figure 2: Breakdown of Japan’s balance on services

(from the first quarter of 1996 to the second quarter of 2020)

Economists view CA equilibrium from two perspectives. The first is long-term optimization. Balancing the CA over decades is important. CA deficits are one factor that has plunged many developing countries into currency and financial crises. On the other hand, the large CA surpluses of Japan in the 1980s and China since 2000 have led to international political issues such as the Japan-US trade conflicts and the China-United States trade war.

Short-term CA imbalances lasting a few years due to economic fluctuations are, however, totally harmless from the perspective of economic science. Intertemporal optimization, which is at the core of dynamic analysis in economics, allows CA to be in imbalance. In order to continue to enjoy stable consumption every year, there must be a CA deficit when production activity declines and a CA surplus when an economy is picking up. CA is responsible for the medium- to long-term adjustment of domestic production excesses and shortfalls through dealings with overseas economies. If CA is balanced in a given year as a result of long-term optimization, this is purely coincidence.

The second is short-term (intratemporal) optimization. Even if the CA in a given year is balanced, it does not mean that there is no international trade. It simply means that the amount of money received from overseas and the amount of money paid overseas are equal. Both receipts and payments may amount to a significant percentage of the gross domestic product. From the perspective of a household, if the CA in a given year is balanced, the same budget can purchase not only domestic products but any goods and services from around the world, maximizing satisfaction or so-called utility of a household.

The fact that in FY2020 the CA of many countries in the world, including Japan, is approaching a balanced position is the result of a large decline in both exports and imports, plus a sharp drop in both receipts and payments for services. In extreme cases—Japan’s national seclusion during the Edo period, for example—if international transactions are reduced to zero, an equilibrium of zero CA for all countries in the world can be achieved. However, this is not desirable for the world economy.

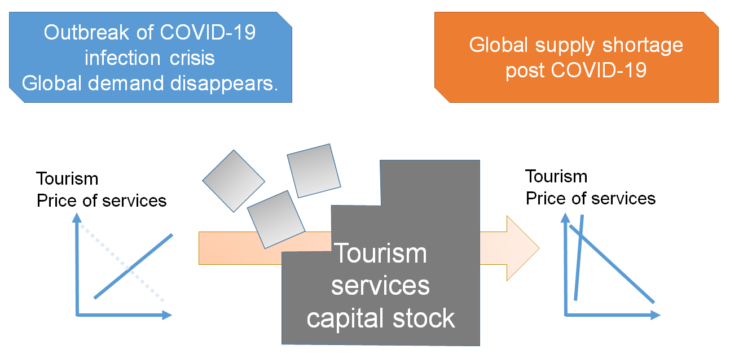

The equilibrium of the balance on services in each country as a result of the curtailed movement of people around the world means that the world economy in 2020 will be forced to make choices that are far from optimal. This can be regarded as a failure of short-term optimization. Moreover, with the demand for international travel services dropping to almost zero over a period of several months, and consequently airlines, travel agencies, the hotel industry, and peripheral service provider industries such as cabs and restaurants in tourist areas continuing to go bankrupt, the accumulation of capital stock in the service industry will inevitably break down. Long-established restaurants in Paris and popular hotels in Honolulu favored by Japanese people may close down. When this happens, even if the COVID-19 Shock were to disappear due to a miraculous drug and the economy were to revert to its pre-COVID-19 state, the price of services may continue to soar due to supply shortages until the capital stock of the service industry is rebuilt according to an optimization criterion. People may hesitate to spend 500,000 yen for a trip abroad that previously cost 200,000 yen. And even if a restaurant or hotel is reopened by a new owner who regards it as a business opportunity, customers may find the premises appear the same as before, but that does not mean they will enjoy the same quality of service as before. This can be regarded as a failure of long-term optimization.

Figure 3. Market for overseas travel services

Note: Figure 3 shows the market for overseas travel services. Even if the demand for overseas travel services (downward-sloping dotted line) dries up during the COVID-19 crisis (left), supply shrinks due to the collapse of businesses, and demand revives post COVID-19 (right), in the equilibrium of the overseas travel services market, prices will soar.

Of course, the unintended reduction in the CA in 2020 is due to the external shock caused by the COVID-19 pandemic, and not the failed policies of governments. However, it is important to know what policies each country will put in place when international service transactions are reactivated once prophylactic vaccines and treatments to alleviate symptoms are developed. Policies to support the tourism services industry through domestic demand during the COVID-19 pandemic such as the “Go To” campaign in Japan are correct from a long-term perspective if the spread of infection can be curbed during the policy implementation period. If countries around the world can get through the COVID-19 period using domestic demand to support the service sector, the people of Japan and the world at large will be able to enjoy normal service trade as soon as people are able to travel on a global scale once more.

Translated from an original article in Japanese written for Discuss Japan. [January 2021]

Keywords

- Yoshida Yushi

- Shiga University

- current account (CA)

- balance of trade

- balance on services

- Global Financial Crisis (2008)

- Great East Japan Earthquake (2011)

- COVID-19 Shock (2020)

- COVID-19

- Great Trade Collapse

- Great Service-Trade Collapse

- CA equilibrium

- tourism

- service industry

- Go To campaign

- domestic demand